Consider this a crash course on getting caught up on fiscal year info. First, we’ll answer some of your most frequently asked questions, and then we’ll give you some practical tips to prepare for fiscal year end like an expert.

More articles you might like:

Fiscal year end FAQs: the basics you need to know

What’s the definition of “Fiscal Year”?

A fiscal year in the US is any 12-month period that businesses and governments use for accounting purposes.

What is the difference between “fiscal year” and “calendar year”?

A fiscal year will frequently coincide with the calendar year, but this is not always the case. The calendar year in many countries will be based on the Gregorian calendar and will start on January 1st and end on December 31st.

However, a fiscal year doesn’t have to start on January 1st and end on December 31st. A company can choose to start it at any point, as long as it spans 12 consecutive months. While you can start it at any time, it’s common practice for business owners to kick off their fiscal year at the beginning of certain quarters.

What is the difference between a “fiscal year” and a “financial year”?

Absolutely nothing. Both terms can be used interchangeably.

When does the fiscal year end?

The fiscal year generally ends on the last day of a quarter. Every year is divided into four 3-month periods known as “quarters,” which are commonly abbreviated to Q1, Q2, Q3, and Q4. For reference, here’s how the quarters in a calendar year are divided:

- Q1: January 1st to March 31st

- Q2: April 1st to June 30th

- Q3: July 1st to September 30th

- Q4: October 1st to December 31st

Most businesses will start their fiscal years on the first of January, April, July or October and then end their fiscal years four quarters later on March 31st, June 30th, September 30th or December 31st.

When is the government financial year end?

The financial year of the United States Federal Government begins on October 1st and ends on September 30th.

What is the best fiscal year end date?

There isn’t a simple answer for the “best” date since choosing a fiscal year will depend on many factors. A company could choose to begin its fiscal year based on the closest date to its incorporation. For example, a company that is incorporated on July 2nd could decide to have its fiscal year span from July 1st to June 30th.

Some companies will time their fiscal year based on their seasonal sales peaks. For example, the natural end of the business year for retail merchants is in January, which is after the Christmas holiday rush. This is why retailers usually begin their fiscal year in February.

Is a tax year different than a fiscal year?

Yes, tax years and fiscal years refer to different concepts, although they can potentially occur during the same periods. A tax year will be the 12-month period in which you record your taxable income and expenses.

Businesses may choose to have their tax year align with the calendar year or they can choose to have their tax year align with their fiscal year. However, the tax years of individuals and sole proprietors must follow the calendar year.

Tips to prepare for fiscal year end

1) Don’t make accounting wait on you to close the fiscal year

As the fiscal year end approaches, an accounting department’s goal will be to prepare the general ledger accounts for the start of the next accounting process. Whether you’re an entry-level employee or managing a team, you will need to prepare any outstanding receipts, expense reports, or other financial files for handoff to accounting. Make sure you’re managing your calendar responsibilities so that you don’t cause any delays for the accounting department.

If your accounting department doesn’t give you a deadline, make a reminder for yourself two to four weeks before the end of the fiscal year in order to get your records and receipts organized. Mark this time in your calendar, write it in your planner, set an alarm, and do whatever you need to do so that you don’t forget.

2) Clean up your financial files before fiscal year end

Ask your accounting department about the types of information and documents that you should keep. Depending on your role and your company, these files could include department budgets, payments to agencies, information about independent contractors, and more.

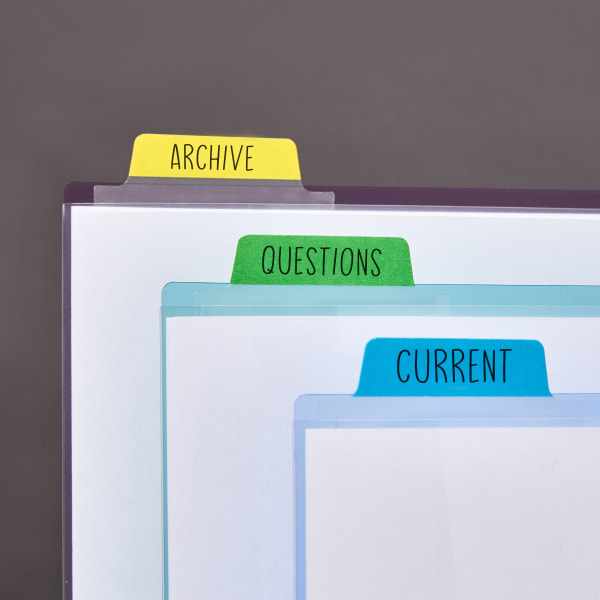

A simple way to simplify your files is by grabbing a file rack or a few paper trays and sorting your files into categories. We like this space-saving file rack because it’s adjustable and durable. Here are some simple categories to help you organize your documents:

- Current: Anything that will continue into the new fiscal year

- Archive: Closed out subscriptions, receipts, and more from the prior fiscal year

- Question: Anything that you think is fine to toss

If you’re ready to throw old financial files away, make sure to double check with your accounting department to confirm that you won’t need those files later. Also make sure that you’re following the proper disposal methods for your company so that documents with confidential information are shredded.

3) Get organized for the upcoming fiscal year

The best time to prepare for the end of the fiscal year is from the very beginning. Plan a filing strategy from the start so that you don’t have to scramble to dig up financial files at the last minute. If you have a planner or calendar, mark your quarterly close-outs and the fiscal year end so that they stay on your radar.

When you’re organizing files, nothing beats file folders for keeping track of physical documents like receipts, copies of expense reports, and more. One way you can organize is by printing file folder labels for each month and using color coding dots to denote the fiscal year’s beginning and end.

Another strategy is to color code by quarter using color-coded file folder labels. In fact, we love these printable file folder labels that come in four colors and are perfect for organizing by yearly quarter.

Make preparation for fiscal year end a habit

With the right preparation, organizing your files doesn’t have to be a daunting task. Firstly, don’t make the accounting department wait on you; give yourself two to four weeks before fiscal year end to get your records and receipts to them. Second, clean up your financial files well before the end of the year. Use simple categories such as “current,” “archive,” and “question” to file paperwork as you go. Lastly, get organized for the upcoming fiscal year. Plan your filing strategy from the start so you don’t have to scramble at the last minute.

Over time, you’ll be able to refine and tailor your filing systems to fit your organization’s needs. And, once you’ve established a habit of organization, the end of each fiscal year will be as simple as pulling a file. Discover more creative ways to stay organized by following us on Pinterest and share your tried-and-true organizational tips with #averyproducts on Instagram.